Think Copper.

Copper is entering a critical phase. Global demand is accelerating faster than new supply can be developed — a dynamic already forcing governments, manufacturers, and institutional investors to secure long-term access now, not later.

For private investors, timing matters. Once shortages become mainstream news, positioning is no longer strategic — it’s reactive. That’s why informed investors are exploring physical copper exposure before the market fully reprices.

New copper projects take years to bring online. Recycling alone cannot close the gap. Meanwhile, electrification, EV adoption, and infrastructure spending continue to rise — regardless of market cycles.

This growing imbalance is why many investors are acting now: to understand their options, evaluate risks, and secure access while availability and pricing structures still allow it.

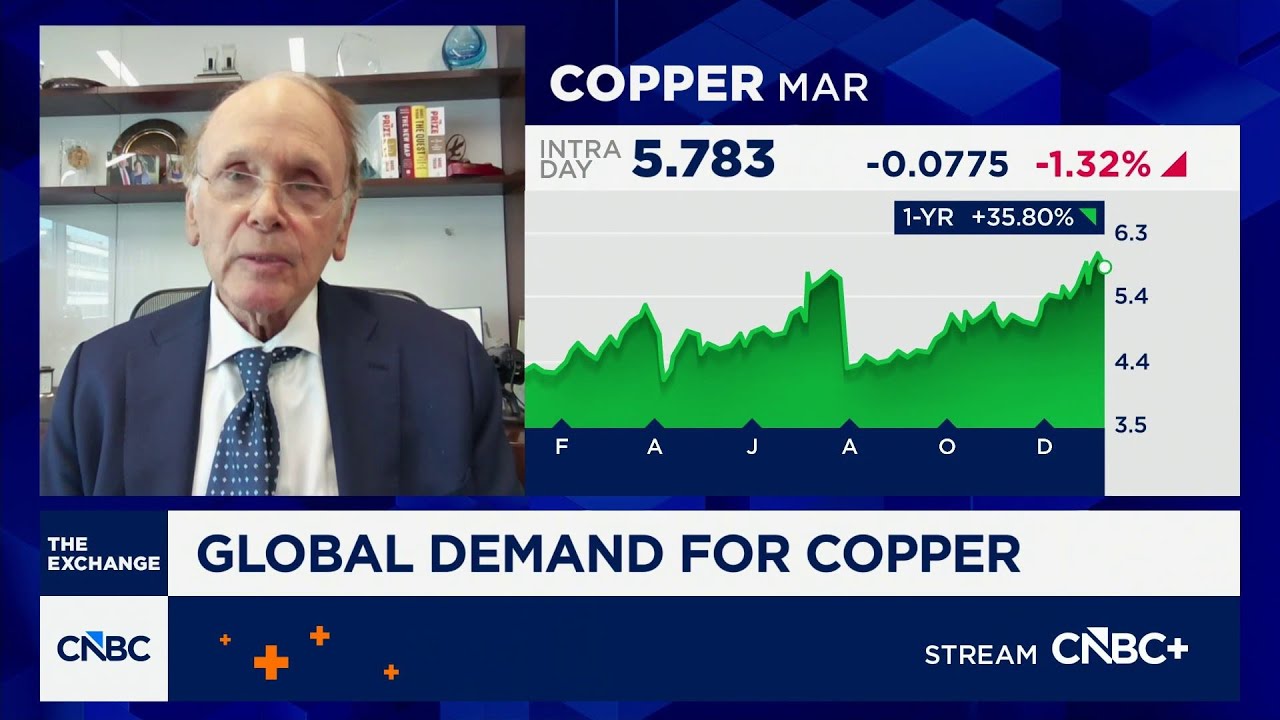

“Copper is surging as demand from electric vehicles, AI infrastructure, and data centers accelerates faster than supply.”

“Copper sits at the heart of electrification, AI, and energy transition — yet new supply is lagging badly.”

"World will need 50% more copper than we have today."

CNBC’s “The Exchange” team discusses global demand for copper amid the AI boom, market outlook and more with Daniel Yergin of S&P Global.

Copper demand is being driven by forces that are already locked in: electrification, EV adoption, AI data centers, and massive grid upgrades. At the same time, new copper mines take 10–15 years to develop, and many projects are delayed or cancelled.

When demand runs ahead of supply for years, price pressure isn’t temporary — it’s structural.

As copper tightens, investors who act early typically benefit from better entry structures, clearer logistics, and more available options. Once shortages become obvious to the wider market, access narrows and decision-making becomes reactive instead of strategic.

Timing doesn’t just affect price — it affects your options.

Major banks, miners, and global institutions are openly discussing copper deficits and long-term supply risks. Historically, private investors who move before mainstream headlines dominate tend to have a positioning advantage.

By the time everyone agrees copper is critical, the opportunity has already shifted.

Global demand for copper is skyrocketing, while new supply struggles to keep up. From EVs to AI infrastructure, the world’s reliance on copper is only growing — and early investors gain the clearest advantage. Learn how physical copper can fit into your portfolio with expert guidance.

BONUS ALERT

Exclusive offer for new investors: secure your physical copper today and get a 48% bonus added to your initial allocation.